SOLAR FINANCING

3.99% * APR with AutoPay

Low rates. Great service. That’s Loans Made Easy.

Whole-project funding, with no fees, no home equity requirements.

The unsecured BCS Lending loan has no fees or prepayment penalties. There are also no appraisals or home equity requirements.

Finance your solar installation, at a low rate.

When you have good credit, you deserve a low-interest, fixed-rate loan. You can be confident that’s what you’ll get with BCS Lending, because we back our low rates with our Rate Beat Program.

We can fund your loan as soon as the day you apply.

You’re in control of the loan process with BCS Lending. You choose your funding date, and you can even have funds deposited into your account as soon as the same day you apply.

You control the terms of your BCS Lending home improvement loan.

Repay your fixed-rate home improvement loan in as little as two years, or take up to 12 years. * When you have good to excellent credit, the choice is yours.

It’s easy to find your rate.

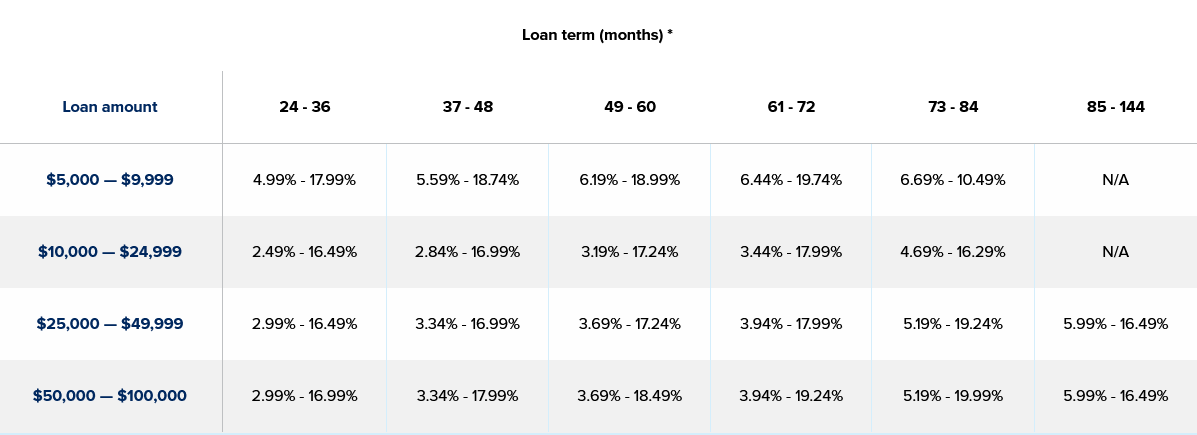

Annual Percentage Rates (APR)

Loan terms:

- Rates quoted with AutoPay option. Invoicing option is 0.50% points higher.

- Fixed rate, simple interest fully amortizing installment loans, no fees or prepayment penalties.

- Loan proceeds may not be used to refinance any existing loan with BCS Lending.

- Florida loans subject to Documentary Stamp Tax. The tax amount is not included in the quoted APR.

What is a home improvement loan?

A home improvement loan is an unsecured personal loan that allows you to borrow money for home upgrades, repairs, renovations and additions. Typically offered by banks, credit unions and online lenders, home improvement loans are an easy, hassle-free way to get funds for your project.

What type of loan is best for home improvement projects?

Home improvement loans are a popular choice for home improvement projects because they offer a fast and easy way to finance your project. At BCS Lending, our home improvement loans are unsecured, which means you don’t need to use your home as collateral and don’t need equity in your home.

Should I get a personal loan for home improvements?

Personal loans are a good choice for quick and easy financing. Applying for a home improvement loan is typically faster than applying for a home equity line of credit (HELOC) or a home equity loan. In fact, BCS Lending allows you to get funds the same day you apply when all conditions are met. 2 Plus, you don’t have to deal with appraisals or paperwork, and you do not need equity.

BCS Lending offers fixed-rate loans, which means your rate won’t change when the market fluctuates, and you can easily budget your payments. Our home improvement loans offer lower interest rates than a credit card, so you can save more of your hard-earned money.

Applying for a personal loan for your home improvement project is a good idea when:

- You have a great credit profile. BCS Lending only accepts customers with good to excellent credit.

- Your cash flow can cover your monthly payment.

- You don’t have equity in your home or don’t want to use it for collateral.

- You want to keep your savings intact.

What is the difference between a home equity line of credit and a home improvement loan?

A home equity line of credit, or HELOC, is a secured line of credit that allows you to borrow against the equity you have in your home. Because of this, HELOCs often have lower interest rates. HELOCs offer revolving credit, which allows you to borrow the funds you need when you need them. Applying for a HELOC often takes longer than a personal loan and typically requires significant paperwork.

BCS Lending offers a fast, easy online application without requiring any paperwork; you also do not need collateral to borrow funds. Instead, your credit profile and whole financial track record are assessed to decide if you qualify for financing.

Consider the type of project you’re doing, your credit, income, and whether you have equity in your home when evaluating your options.

What is the difference between a home equity loan and a home improvement loan?

A home equity loan is also referred to as a second mortgage. Just as with a home improvement loan, you receive requested funds up front and repay them over a designated period of time.

Unlike home improvement loans, home equity loans do require you to use your home as collateral and, typically, you must own 20% or more of your home to apply.

How does a home improvement loan work?

Home improvement loans allow you to borrow funds for your home improvement project without requiring collateral, a home title, or an appraisal. BCS Lending offers a quick, easy online application that you can complete from any device and the comfort of your home.

You can borrow between $5,000 and $100,000, and choose a repayment period that works best for you. BCS Lending has no restrictions on the type of home improvement project your funds can cover.

Here is how it works:

Apply online. You will receive a response shortly (during business hours).

Accept the loan agreement. Once approved, e-sign your loan agreement and set up your loan for funding.

That’s it! Use your loan. Receive your funds as early as today!

How long do you have to pay back a home improvement loan?

Home improvement loans are paid back in installments, or regular monthly payments, depending on the size of the loan and the lender.

BCS Lending offers personal loans for home improvement with flexible terms up to 12 years * so you can choose a repayment period that works best for you.

How can I get a home improvement loan with no equity?

How much can you get a home improvement loan for?

When you have good credit, BCS Lending offers low-interest, fixed-rate loans, from $5,000 to $100,000, for practically any home improvement project you want.

What are the benefits of a BCS Lending home improvement loan?

- Low, fixed rates

- Predictable monthly payment

- Lower APR than a credit card

- Fast application

- Easy to get funds

- Funds are directly deposited into your account as soon the day you apply when conditions are met